Payroll and taxes in a nanny share

Building a Foundation for Success: Setting Up Your Nanny Share Payroll Correctly from Day One

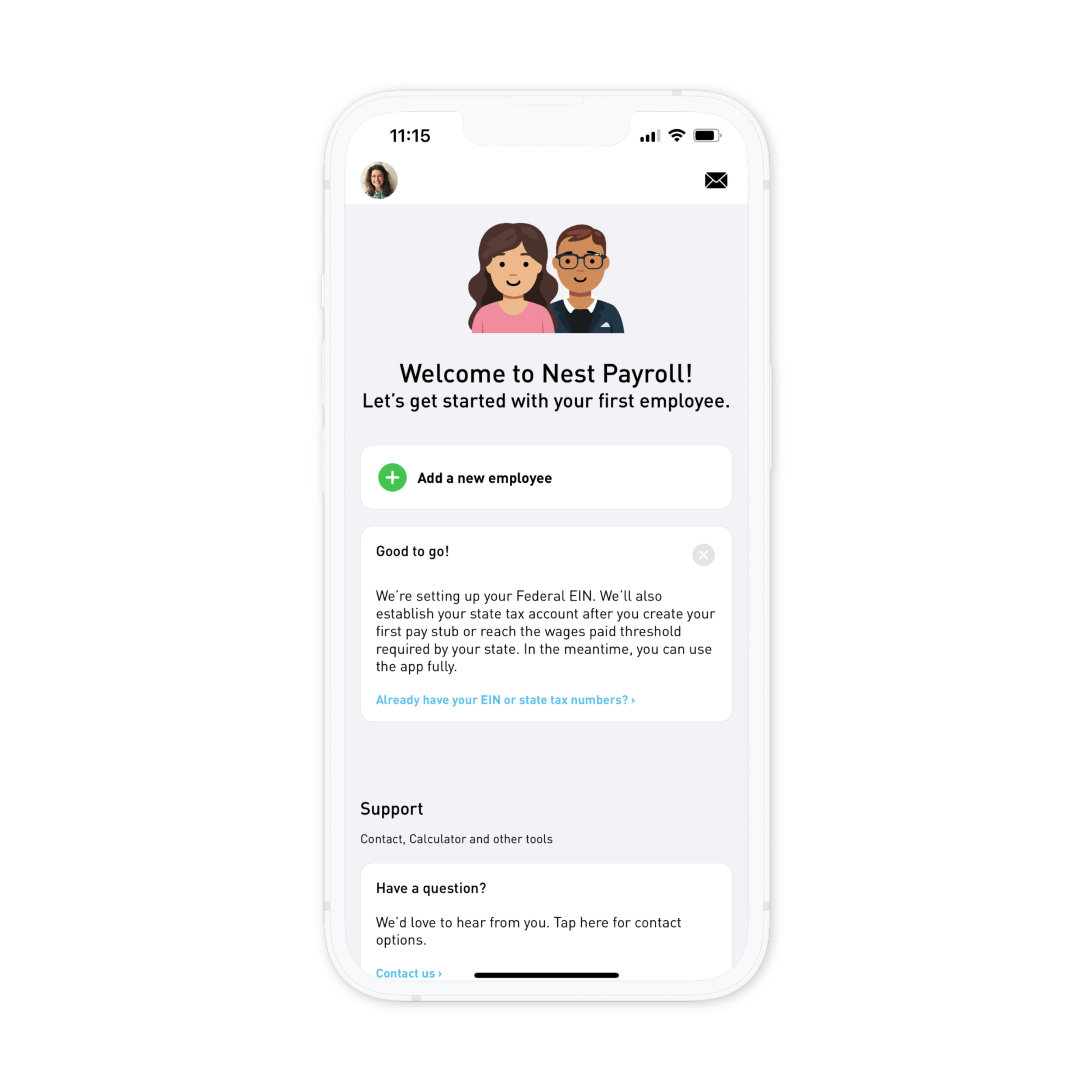

Paying for care in a nanny share arrangement correctly from the get-go helps ensure smooth sailing. It sounds complicated, but it’s actually straight-forward.

Each family is a separate employer in the eyes of the IRS, which means each has their own federal EIN and state tax accounts, and their own payroll account (unless they are handling the payroll on their own). If another family in the share is not following the tax laws (i.e., paying under the table), that doesn’t affect the family that is following the tax laws.

Each family, when paying legally, can apply for the child and dependent care tax credit, and also take advantage of a FSA if available through their work.

It’s typical for each family to pay two-thirds of a normal going rate, so the families save money and the nanny makes more money, a win for all.

Each family needs to pay at least the minimum wage requirements in their city/state.

Sometimes you need to pay more than the hourly rate due to changes in how many children might be taken care of. For example, there may be a school holiday and you have asked your nanny to include your older child who is normally in school. Nest Payroll makes this easy! In the example below, a family pays 20 hours at the regular rate of $25/hour, and they also are paying an additional 8 hours at the rate of $30/hour because they added an additional child for one day. The regular and the alternate rate will be detailed on the pay stub for your nanny.

Need to pay an alternate rate for some of the hours worked? Simply enter the additional rate and the hours while creating the pay stub.

Related article: