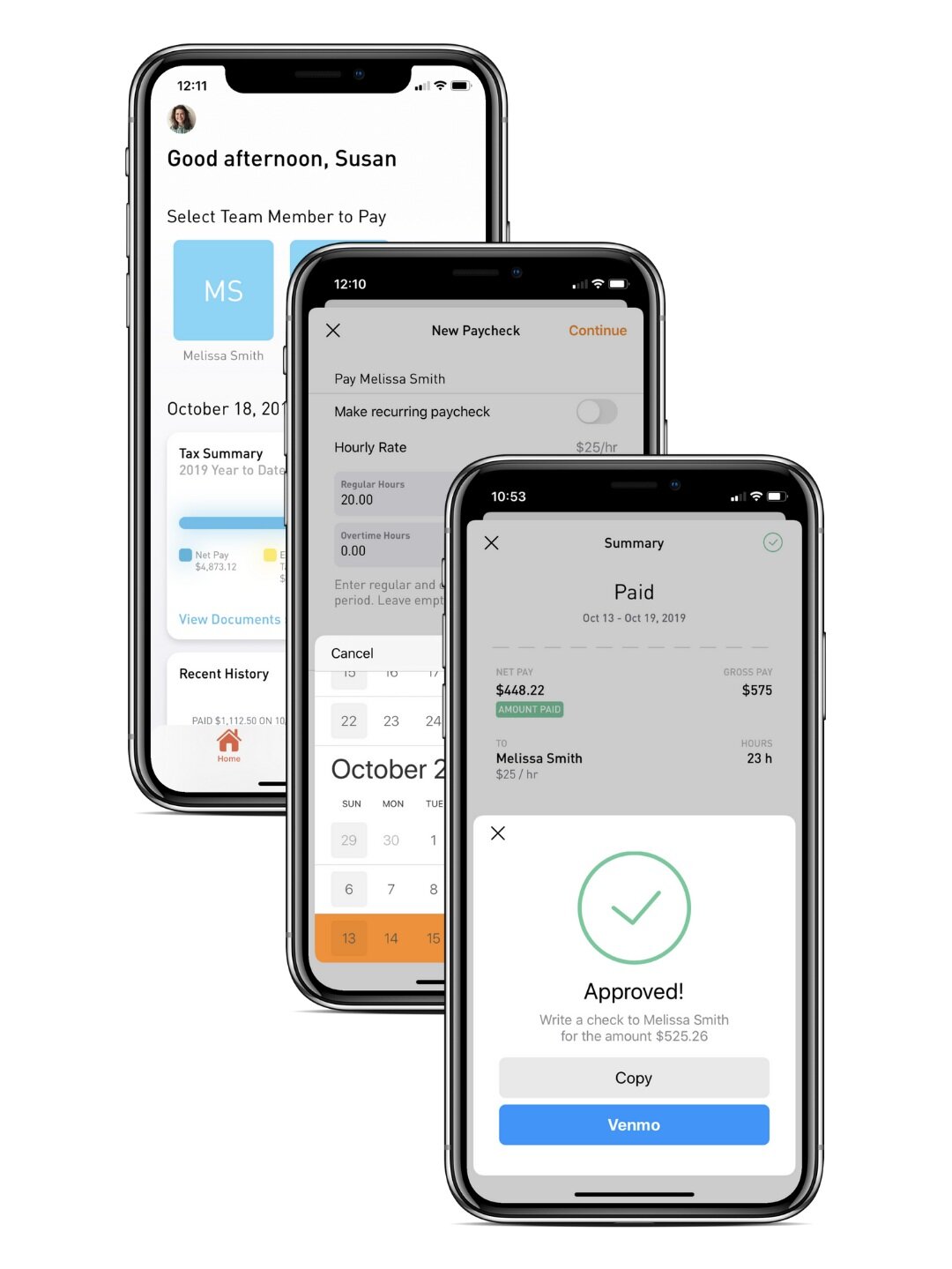

Three steps to easy payroll.

Get going in 5 minutes.

SUBSCRIBE HERE $42/month + 14 day free trial

Continue in your browser or download the app.

Enter your basic employer information.

Authorize Nest Payroll to handle your tax work.

2. Add your employee.

Include vacation and sick time hours for tracking, and even add tax-free health care and education reimbursements to reduce taxes for everyone.

3. Pay them in a flash.

Anytime, anywhere - browser or phone compatible.

Integrated payments (Cash App or Venmo), or separately

pay with Zelle or write a check.

Professional pay stubs automatically emailed.

Employees can receive “on the books” payments quickly.

Never forget with reminders; set up recurring pay stubs.

We take care of everything else.

We manage your federal taxes.

Obtain your Federal Employer Identification Number (EIN)

Quarterly estimated IRS tax payments (1040-ES)

Year-end tax documents: W-2s, W-3, Schedule H

We manage your state taxes and to-do’s.

File your employee’s new hire report

Register and maintain required state tax accounts

Prepare and file your quarterly/annual tax reports and payments

You keep your money until it’s truly due.

The IRS and your state debit your bank account directly when quarterly and year-end tax payments are due

We don’t touch your money

You receive account notifications prior, no surprises

Everything’s at your fingertips.

Notifications keep you informed

History of pay stubs, tax payments and reports

Tax forms like W-2s, Schedule H, all easy to share

And we’re here to help.

Concierge email support

Resources to help with hiring, tax breaks and more

Read our FAQs to delve deeper!